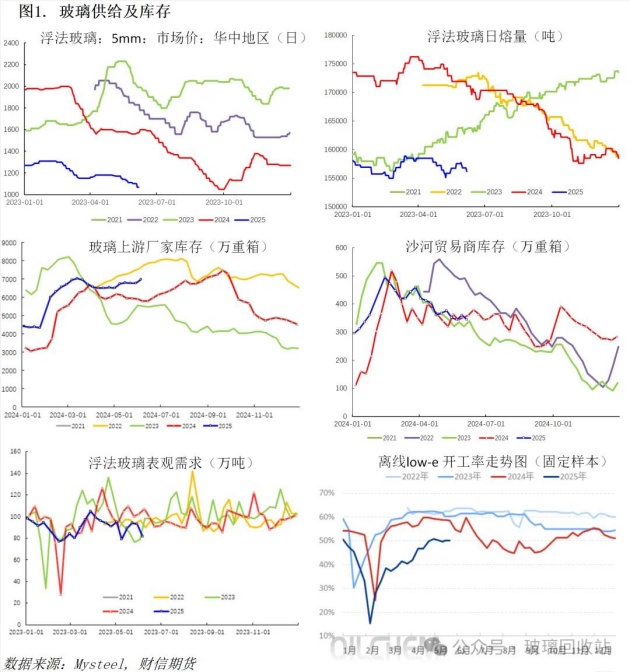

On the supply side, according to MySteel data, as of June 6, 2025, the daily output of float glass in China was 156,800 tons, and the output of float glass in China was 1,097,900 tons, -0.56% month-on-month and -8.64% year-on-year. On the demand side, at the end of May, the operating rate of China's LOW-E glass sample enterprises was 79.9%, flat month-on-month. At the end of May, the average number of order days of the national deep processing sample enterprises was 10.35 days, -0.5% month-on-month and -4.2% year-on-year. The large and medium-sized orders in the engineering category of the deep processing industry are still relying on the capital situation to negotiate or execute, and the production status is basically maintained, but the industry profits are seriously squeezed, and the processing cost of ordinary tempered glass is low. Although the volume of individual orders in the industry is slightly better than that of engineering labor, the order volume is not as good as that of the same period last year.

From the inventory point of view, as of this Thursday, the total inventory of float glass sample enterprises in the country was 69.754 million heavy boxes, +2.092 million heavy boxes month-on-month, +3.09% month-on-month, and +20.15% year-on-year. Regionally, the shipments of most enterprises in North China have slowed down, the enthusiasm of dealers to purchase has weakened, and the accumulation of factories has increased month-on-month. The float glass market in East China is dominated by the rise in storage, which coincides with the Dragon Boat Festival holiday, and the overall production and sales are difficult to achieve a balance. The central China market was affected by the holiday factor in the second half of the week, and the production and sales of some enterprises improved. The overall shipments of enterprises in South China are not good, although some enterprises have better shipments after the holiday, but the overall regional inventory still increased slightly.

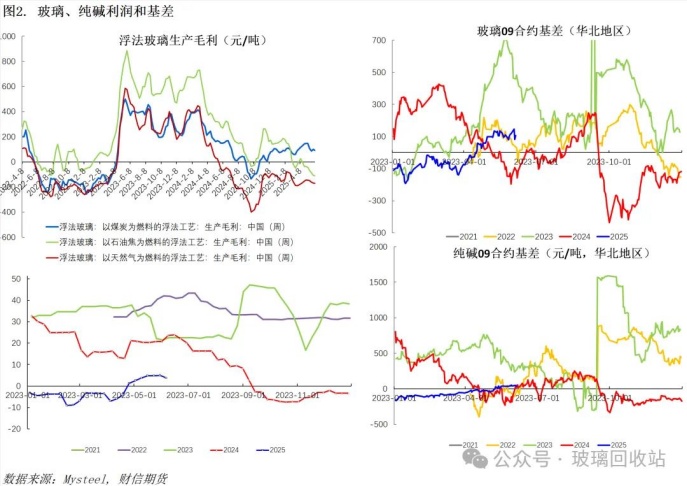

This week, according to the production cost calculation model of Longzhong Information, the average weekly profit of float glass fueled by natural gas, coal-to-gas and petroleum coke was -170.68 yuan/ton, 90.96 yuan/ton and -111.33 yuan/ton, respectively, a decrease of 2.71 yuan/ton, a decrease of 9.14 yuan/ton, and a decrease of 4.29 yuan/ton.

From the perspective of high-frequency data tracking, glass is in a situation of "low profit + low price + low supply". In the first half of the year, only in March and April, during the seasonal recovery of demand, there was a short period of destocking, the overall production and sales rate was weak, coupled with the continuous reduction of spots, a large number of warehouse receipts were registered, and the center of gravity of the disk continued to move downward. Entering mid-May, the easing of tariffs between China and the United States has brought about an improvement in macro sentiment, and the decline of float glass has slowed down. In accordance with the requirements of the government, the Shahe gas line is expected to complete the technical transformation in August and October, switching to centralized gas supply or natural gas, involving a production capacity of about 3,000 tons, and the technical transformation will increase the cost of the production line.

However, from the perspective of the current reality, float glass is in the off-season, facing the pressure of seasonal weakening demand, and the high inventory in the upstream still continues to suppress the disk. At present, the weakening of the spot representing the reality has begun to be realized, and the glass 2509 contract has also continued to discount the spot price of Central China for delivery. However, the cost of glass maintenance is high, and it is difficult to resume production in the short term once the production is stopped.

Considering the recent easing of tariffs between China and the United States, July is also a domestic policy window, with the decline in prices, the probability of the introduction of domestic demand-oriented policies to support the bottom is also increasing, once the large-scale cold repair is cashed, the probability of a medium-term rebound in glass is gradually increasing.

Name: Litong Glass

Mobile:+86 16632961602

Tel:+86 16632961602

Email:vip@litongglass.com

Add:Shahe city,Hebei,China